All Categories

Featured

Table of Contents

There is no payment if the plan expires prior to your fatality or you live past the plan term. You might have the ability to restore a term policy at expiry, however the costs will be recalculated based upon your age at the time of renewal. Term life insurance policy is usually the the very least expensive life insurance policy readily available because it uses a death benefit for a limited time and does not have a money value part like long-term insurance.

At age 50, the premium would certainly increase to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for men and ladies in excellent health and wellness.

Which Of The Following Is Not A Characteristic Of Term Life Insurance

The minimized risk is one element that allows insurance providers to bill lower costs. Rate of interest, the financials of the insurance coverage business, and state policies can likewise impact premiums. Generally, firms usually use far better rates at the "breakpoint" protection levels of $100,000, $250,000, $500,000, and $1,000,000. When you think about the quantity of coverage you can get for your premium dollars, term life insurance policy tends to be the least pricey life insurance policy.

Thirty-year-old George desires to shield his family in the not likely event of his early death. He purchases a 10-year, $500,000 term life insurance policy policy with a premium of $50 each month. If George passes away within the 10-year term, the policy will pay George's recipient $500,000. If he dies after the plan has run out, his recipient will certainly obtain no benefit.

If George is identified with a terminal ailment throughout the very first policy term, he most likely will not be qualified to restore the plan when it runs out. Some policies provide guaranteed re-insurability (without evidence of insurability), however such functions come with a higher price. There are a number of sorts of term life insurance.

Usually, a lot of firms provide terms ranging from 10 to 30 years, although a few offer 35- and 40-year terms. Level-premium insurance coverage (life insurance level term or decreasing) has a fixed month-to-month settlement for the life of the plan. A lot of term life insurance policy has a degree premium, and it's the kind we have actually been referring to in the majority of this write-up.

Best Term Life Insurance In Uae

Term life insurance policy is appealing to young individuals with youngsters. Moms and dads can get significant coverage for a low expense, and if the insured dies while the plan is in impact, the family members can depend on the death benefit to change lost earnings. These policies are also appropriate for individuals with expanding family members.

The ideal choice for you will certainly depend on your needs. Below are some points to think about. Term life plans are perfect for people that want considerable insurance coverage at a low expense. People who own entire life insurance policy pay more in premiums for less insurance coverage however have the protection of understanding they are safeguarded permanently.

The conversion motorcyclist must enable you to convert to any kind of long-term plan the insurance provider offers without limitations - which of the following best describes term life insurance. The key features of the cyclist are preserving the initial health and wellness rating of the term policy upon conversion (even if you later on have wellness issues or come to be uninsurable) and determining when and just how much of the insurance coverage to transform

Of training course, overall premiums will certainly raise dramatically considering that whole life insurance policy is more expensive than term life insurance. Medical problems that establish throughout the term life duration can not trigger costs to be raised.

Whole life insurance policy comes with significantly higher month-to-month costs. It is suggested to supply protection for as long as you live.

Increasing Premium Term Life Insurance

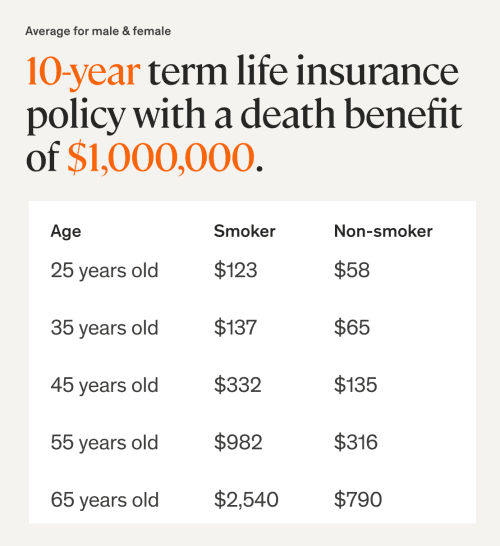

Insurance companies established a maximum age limitation for term life insurance coverage policies. The premium likewise climbs with age, so a person aged 60 or 70 will certainly pay considerably more than somebody years younger.

Term life is rather similar to cars and truck insurance policy. It's statistically unlikely that you'll need it, and the premiums are cash down the tubes if you do not. If the worst takes place, your family members will obtain the advantages.

This policy layout is for the client that needs life insurance yet wish to have the capacity to choose exactly how their cash money value is spent. Variable policies are underwritten by National Life and dispersed by Equity Solutions, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor information, see Long-term life insurance policy develops cash money worth that can be borrowed. Policy car loans accumulate interest and overdue policy loans and passion will lower the survivor benefit and cash worth of the plan. The amount of cash money value available will normally depend on the sort of long-term plan purchased, the quantity of coverage bought, the length of time the plan has been in pressure and any type of outstanding policy financings.

Nevada Term Life Insurance

A full statement of protection is discovered only in the policy. Insurance policy policies and/or connected riders and functions may not be available in all states, and policy terms and problems might vary by state.

The major differences between the different types of term life plans on the market involve the length of the term and the insurance coverage amount they offer.Level term life insurance policy features both degree premiums and a level survivor benefit, which indicates they remain the exact same throughout the duration of the policy.

, also understood as an incremental term life insurance coverage plan, is a policy that comes with a death advantage that boosts over time. Typical life insurance coverage term sizes Term life insurance is inexpensive.

The major differences between term life and whole life are: The size of your insurance coverage: Term life lasts for a set duration of time and then ends. Typical monthly entire life insurance price is determined for non-smokers in a Preferred health category, acquiring a whole life insurance coverage policy paid up at age 100 supplied by Policygenius from MassMutual. Aflac supplies many long-term life insurance coverage policies, consisting of entire life insurance, final cost insurance coverage, and term life insurance.

Latest Posts

$500 000 Term Life Insurance Quotes

How To Sell Final Expense Over The Phone

Best Burial Insurance Policies