All Categories

Featured

Table of Contents

When life quits, the dispossessed have no choice yet to maintain relocating. Virtually promptly, households need to manage the complicated logistics of fatality adhering to the loss of an enjoyed one. This can include paying costs, dividing properties, and taking care of the interment or cremation. While fatality, like tax obligations, is unavoidable, it does not have to concern those left behind.

In addition, a complete fatality advantage is typically given for accidental death. A customized death advantage returns costs usually at 10% rate of interest if death takes place in the initial two years and includes the most kicked back underwriting.

To underwrite this business, firms rely upon individual health and wellness meetings or third-party information such as prescription histories, fraudulence checks, or car records. Financing tele-interviews and prescription histories can usually be utilized to aid the agent finish the application process. Historically firms depend on telephone interviews to verify or confirm disclosure, however more lately to boost customer experience, business are depending on the third-party data showed over and providing immediate decisions at the point of sale without the interview.

How Does Burial Insurance Work

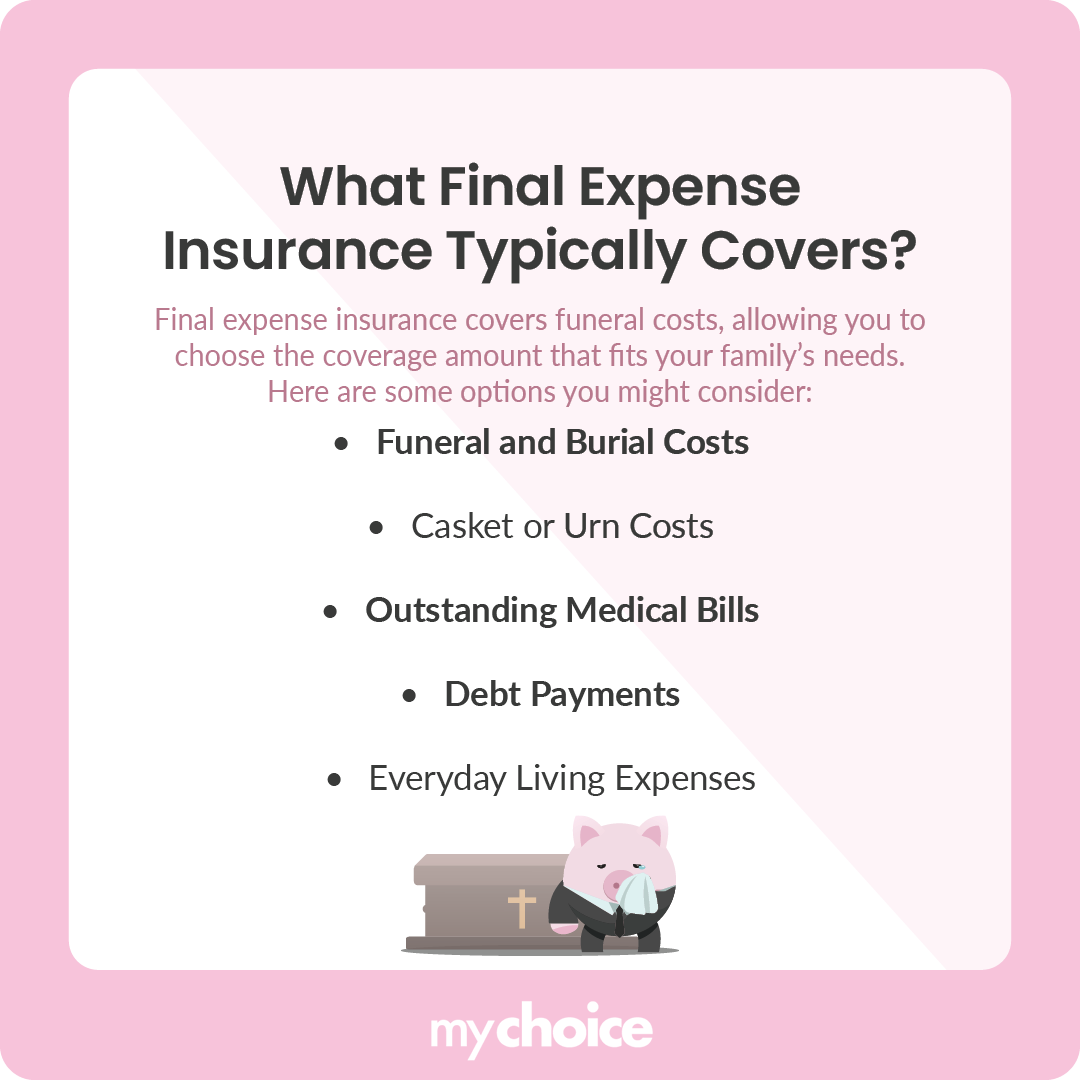

However what is final expense insurance, and is it constantly the very best course onward? Listed below, we have a look at exactly how last expense insurance works and aspects to take into consideration prior to you acquire it. Technically, final expense insurance coverage is a entire life insurance policy policy particularly marketed to cover the expenditures linked with a funeral, memorial service, reception, cremation and/or burial.

While it is explained as a policy to cover final costs, beneficiaries who receive the fatality benefit are not required to use it to pay for final costs they can utilize it for any purpose they such as. That's because final expenditure insurance policy really falls under the classification of customized whole life insurance policy or simplified problem life insurance coverage, which are commonly whole life policies with smaller sized survivor benefit, commonly in between $2,000 and $20,000.

Our opinions are our own. Burial insurance is a life insurance coverage plan that covers end-of-life expenses.

Final Express Direct

Burial insurance coverage needs no clinical test, making it accessible to those with clinical conditions. The loss of a liked one is psychological and terrible. Making funeral prep work and discovering a way to pay for them while regreting includes another layer of stress and anxiety. This is where having funeral insurance, additionally called last expenditure insurance, is available in convenient.

Simplified problem life insurance coverage calls for a wellness assessment. If your health and wellness status disqualifies you from typical life insurance policy, burial insurance might be an option.

Contrast budget friendly life insurance coverage choices with Policygenius. Term and permanent life insurance policy, burial insurance coverage can be found in a number of kinds. Take a look at your protection alternatives for funeral service expenses. Guaranteed-issue life insurance policy has no health demands and offers quick approval for insurance coverage, which can be helpful if you have extreme, terminal, or numerous health and wellness conditions.

Life Expense Coverage

Simplified concern life insurance doesn't need a medical examination, yet it does need a health and wellness questionnaire. This policy is best for those with mild to modest health conditions, like high blood stress, diabetes, or bronchial asthma. If you do not want a medical examination but can get approved for a streamlined concern plan, it is typically a far better bargain than an ensured issue policy due to the fact that you can obtain even more coverage for a less expensive premium.

Pre-need insurance is high-risk because the beneficiary is the funeral chapel and protection is details to the chosen funeral chapel. Should the funeral chapel go out of organization or you vacate state, you might not have protection, which beats the function of pre-planning. Additionally, according to the AARP, the Funeral Consumers Partnership (FCA) encourages versus getting pre-need.

Those are essentially interment insurance coverage policies. For guaranteed life insurance coverage, costs calculations depend on your age, sex, where you live, and protection amount.

Burial insurance coverage supplies a streamlined application for end-of-life protection. The majority of insurance companies need you to talk to an insurance policy agent to apply for a policy and get a quote.

The goal of having life insurance policy is to alleviate the worry on your liked ones after your loss. If you have a supplemental funeral plan, your enjoyed ones can use the funeral plan to manage last expenditures and obtain an instant disbursement from your life insurance coverage to deal with the mortgage and education prices.

Individuals who are middle-aged or older with clinical conditions might think about burial insurance policy, as they may not qualify for standard plans with stricter authorization criteria. Furthermore, burial insurance coverage can be handy to those without extensive financial savings or standard life insurance coverage. Burial insurance policy varies from various other kinds of insurance because it supplies a reduced fatality advantage, usually only adequate to cover costs for a funeral service and other linked prices.

Final Expense Life Insurance Company

News & Globe Record. ExperienceAlani has actually examined life insurance policy and pet dog insurance provider and has actually written various explainers on traveling insurance, credit history, financial obligation, and home insurance. She is passionate regarding debunking the intricacies of insurance and other individual financing topics to ensure that visitors have the information they require to make the finest money decisions.

Last expense life insurance coverage has a number of advantages. Final cost insurance coverage is usually suggested for elders that might not qualify for conventional life insurance due to their age.

Additionally, last cost insurance policy is beneficial for individuals who intend to spend for their own funeral. Funeral and cremation services can be pricey, so final cost insurance coverage gives satisfaction understanding that your enjoyed ones will not need to utilize their financial savings to spend for your end-of-life setups. Nevertheless, last cost coverage is not the best product for every person.

Online Funeral Quote

Obtaining whole life insurance with Values is fast and very easy. Insurance coverage is readily available for elders between the ages of 66-85, and there's no medical test required.

Based on your actions, you'll see your approximated rate and the amount of coverage you get approved for (in between $1,000-$30,000). You can acquire a plan online, and your protection begins instantaneously after paying the first premium. Your rate never ever changes, and you are covered for your whole life time, if you continue making the regular monthly settlements.

When you offer last expenditure insurance policy, you can provide your clients with the tranquility of mind that comes with knowing they and their families are prepared for the future. Ready to find out every little thing you require to recognize to start marketing final expense insurance policy efficiently?

In enhancement, customers for this type of plan could have serious lawful or criminal histories. It is very important to keep in mind that various carriers offer a variety of issue ages on their assured concern plans as reduced as age 40 or as high as age 80. Some will likewise offer greater face worths, up to $40,000, and others will permit better survivor benefit problems by enhancing the rate of interest with the return of premium or lessening the variety of years till a complete survivor benefit is readily available.

Latest Posts

$500 000 Term Life Insurance Quotes

How To Sell Final Expense Over The Phone

Best Burial Insurance Policies