All Categories

Featured

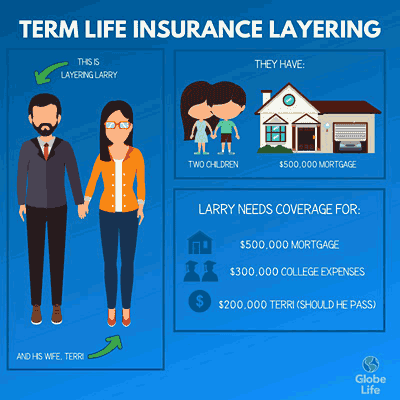

Take Into Consideration Utilizing the dollar formula: DIME represents Financial obligation, Income, Home Loan, and Education. Total your financial obligations, home mortgage, and university expenditures, plus your wage for the number of years your household needs security (e.g., until the youngsters run out the house), which's your insurance coverage need. Some monetary experts determine the quantity you need utilizing the Human Life Worth viewpoint, which is your life time earnings potential what you're making currently, and what you anticipate to earn in the future.

One method to do that is to seek business with solid Monetary strength rankings. what is a 30 year term life insurance. 8A company that finances its very own plans: Some business can offer policies from another insurance provider, and this can include an added layer if you intend to transform your policy or in the future when your household needs a payment

Term Life Insurance Vs Accidental Death

Some business use this on a year-to-year basis and while you can anticipate your rates to climb considerably, it may deserve it for your survivors. One more way to compare insurance coverage business is by looking at online consumer evaluations. While these aren't most likely to tell you a lot regarding a company's economic security, it can inform you how easy they are to deal with, and whether claims servicing is an issue.

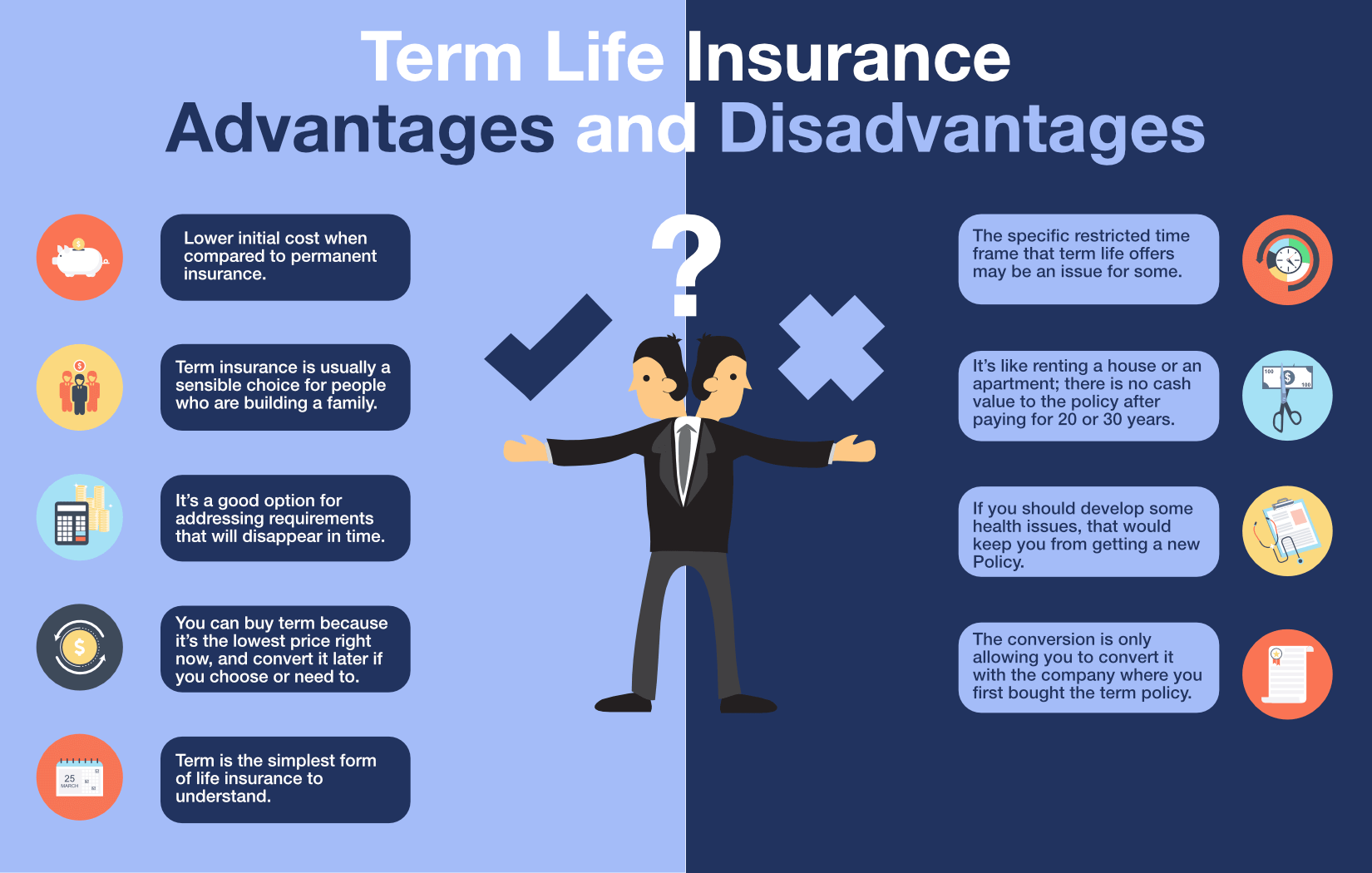

When you're more youthful, term life insurance policy can be a straightforward way to safeguard your enjoyed ones. However as life modifications your monetary top priorities can as well, so you may desire to have whole life insurance for its lifetime coverage and fringe benefits that you can use while you're living. That's where a term conversion comes in - 5 year term life insurance rates.

Authorization is ensured regardless of your health and wellness. The premiums will not enhance as soon as they're set, however they will go up with age, so it's an excellent concept to secure them in early. Discover more concerning exactly how a term conversion functions.

1Term life insurance coverage offers momentary protection for an important period of time and is usually less costly than irreversible life insurance coverage. a return of premium life insurance policy is written as what type of term coverage. 2Term conversion guidelines and restrictions, such as timing, might use; for instance, there may be a ten-year conversion benefit for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance policy Acquisition Alternative in New York City. 4Not readily available in every state. There is an expense to exercise this rider. Products and bikers are offered in authorized territories and names and attributes may differ. 5Dividends are not guaranteed. Not all participating plan proprietors are eligible for dividends. For choose cyclists, the condition uses to the guaranteed.

Latest Posts

$500 000 Term Life Insurance Quotes

How To Sell Final Expense Over The Phone

Best Burial Insurance Policies